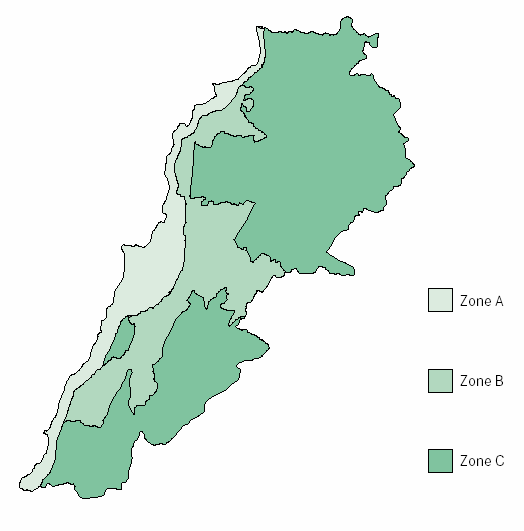

Zone A:

These areas will benefit from the following exemptions, reductions and facilities:

1- Work Permit of various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed against one foreigner, and are registered in the NSSF.

2- Exemption from Income Tax for 2 years (from the date of listing the shares on the Beirut Stock Exchange), provided that the effective negotiable shares are no less than 40% of the capital of the Company.

Zone B:

These areas will benefit from the following exemptions, reductions and facilities:

1- Work Permit of various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed against one foreigner, and are registered in the NSSF.

2- Exemption from Income Tax for 2 years (from the date of listing the shares on the Beirut Stock Exchange), provided that the effective negotiable shares are no less than 40% of the capital of the Company. This exemption period shall be added to any other exemption period enjoyed by the Company.

3- A 50% reduction in income taxes and taxes on project dividends, for a period of five years. Reduction shall apply from the date of commencement of exploitation of the project governed by the provisions of this law. In the event that the investor benefits from the aforementioned exemptions related to the listing of shares at the Beirut Stock Exchange, reduction shall apply after the lapse of that exemption period.

Zone C:

1- Work Permit of various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed against one foreigner, and are registered in the NSSF.

2- Exemption from Income Tax for 2 years (from the date of listing the shares on the Beirut Stock Exchange), provided that the effective negotiable shares are no less than 40% of the capital of the Company. This exemption period shall be added to any other exemption period enjoyed by the Company.

3- A full exemption for 10 years from income taxes and taxes on project dividends, for a period of five years. Reduction shall apply from the date of commencement of exploitation of the project governed by the provisions of this law. In the event that the investor benefits from the aforementioned exemptions related to the listing of shares at the Beirut Stock Exchange, reduction shall apply after the lapse of that exemption period.