a. Definition and Characteristics:

The Holding Company in Lebanon was introduced by the legislative Decree No. 45 dated 24/06/1983.

The main characteristics of the Holding Company as defined by the said decree are as follows:

1. Legal Status: The Holding Company shall take the form of a Joint Stock Company and shall abide by the same law provisions governing this form of companies, with some exceptions to be described below.

a. Definition and Main Characteristics:

The Offshore Company in Lebanon was introduced by the legislative Decree No. 46 dated 24/06/1983.

The main characteristics of the Offshore Company as defined by the said decree are as follows:

1. Legal Status: The Offshore Company shall take the form of a Joint Stock Company and shall abide by the same law provisions governing this form of companies, with some exceptions to be described below.

Foreign Companies may operate in Lebanon either as a Branch or as a Representative Office.

a. Branch of a Foreign Company:

A Branch may engage in any business activity listed in the Foreign Company’s Articles of Association provided that it does not contravene Lebanese Law.

Lebanon charges stamp duties on all legal documents and agreements including amounts of moneys. The rate of the stamps duties tax is 0.3% of the amounts included in the documents and agreement to be paid within 5 days from their signature. The rate is reduced to 0.15% in respect of commercial bills.

Offshore companies are exempt from Stamp duties on overseas contracts signed in Lebanon.

The Law differentiates between daily employments and earnings from practicing a profession or trade. Salaries are taxed on a sliding scale. The Tax rate is as low as 2% and as high as 20%.

Gross Income is the sum total of salaries, allowances, annuities, bonuses, pension, and other benefits after the deduction of LBP/7.500.000/ per person to which shall be added LBP/2.500.000/ for the married taxpayer and LBP/500.000/ per legitimate child under his custody.

i. Joint Stock and Limited Liability Companies:

1. 15% tax on Business Profit.

2. 7.5% tax on profits received from the development or sale of real estate.

Joint Partnerships, limited Partnerships, Joint ventures as well as Merchants and Businessmen are taxed at progressive rates starting from 4% up to 21%

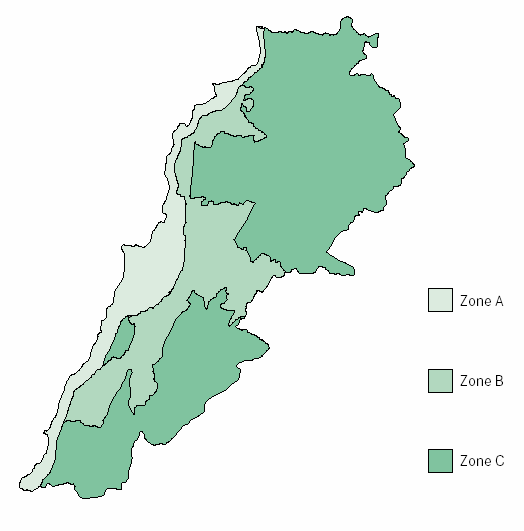

Zone A:

These areas will benefit from the following exemptions, reductions and facilities:

1- Work Permit of various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed against one foreigner, and are registered in the NSSF.

2- Exemption from Income Tax for 2 years (from the date of listing the shares on the Beirut Stock Exchange), provided that the effective negotiable shares are no less than 40% of the capital of the Company.

Zone B:

These areas will benefit from the following exemptions, reductions and facilities:

1- Work Permit of various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed against one foreigner, and are registered in the NSSF.

2- Exemption from Income Tax for 2 years (from the date of listing the shares on the Beirut Stock Exchange), provided that the effective negotiable shares are no less than 40% of the capital of the Company. This exemption period shall be added to any other exemption period enjoyed by the Company.

3- A 50% reduction in income taxes and taxes on project dividends, for a period of five years. Reduction shall apply from the date of commencement of exploitation of the project governed by the provisions of this law. In the event that the investor benefits from the aforementioned exemptions related to the listing of shares at the Beirut Stock Exchange, reduction shall apply after the lapse of that exemption period.

Zone C:

1- Work Permit of various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed against one foreigner, and are registered in the NSSF.

2- Exemption from Income Tax for 2 years (from the date of listing the shares on the Beirut Stock Exchange), provided that the effective negotiable shares are no less than 40% of the capital of the Company. This exemption period shall be added to any other exemption period enjoyed by the Company.

3- A full exemption for 10 years from income taxes and taxes on project dividends, for a period of five years. Reduction shall apply from the date of commencement of exploitation of the project governed by the provisions of this law. In the event that the investor benefits from the aforementioned exemptions related to the listing of shares at the Beirut Stock Exchange, reduction shall apply after the lapse of that exemption period.